Cheaper car insurance in UAE can be a blessing in the time of budgeting and fast-moving expenditures. But knowing some tips and tricks regarding car insurance policies and premium setting you can save a lot of money then you can imagine.

In today date many insurance providers are offering discount packages on car insurance but if you start purchasing them with a blind eye and without proper knowledge of how car insurance terms and conditions work then you are making a grave mistake.

You need to analyze how the price of car insurance is determined and how car quotes and monthly premium plays a vital role in it.

Our experts have highlighted numerous factors that can make you get cheaper car insurance if you are aware of them for instance how the age of the client, type of insurance policy, car conditions affect your overall premium.

Therefore, considering many other significant factors, buy insurance present you the useful tips to get cheaper car insurance in the UAE within no time.

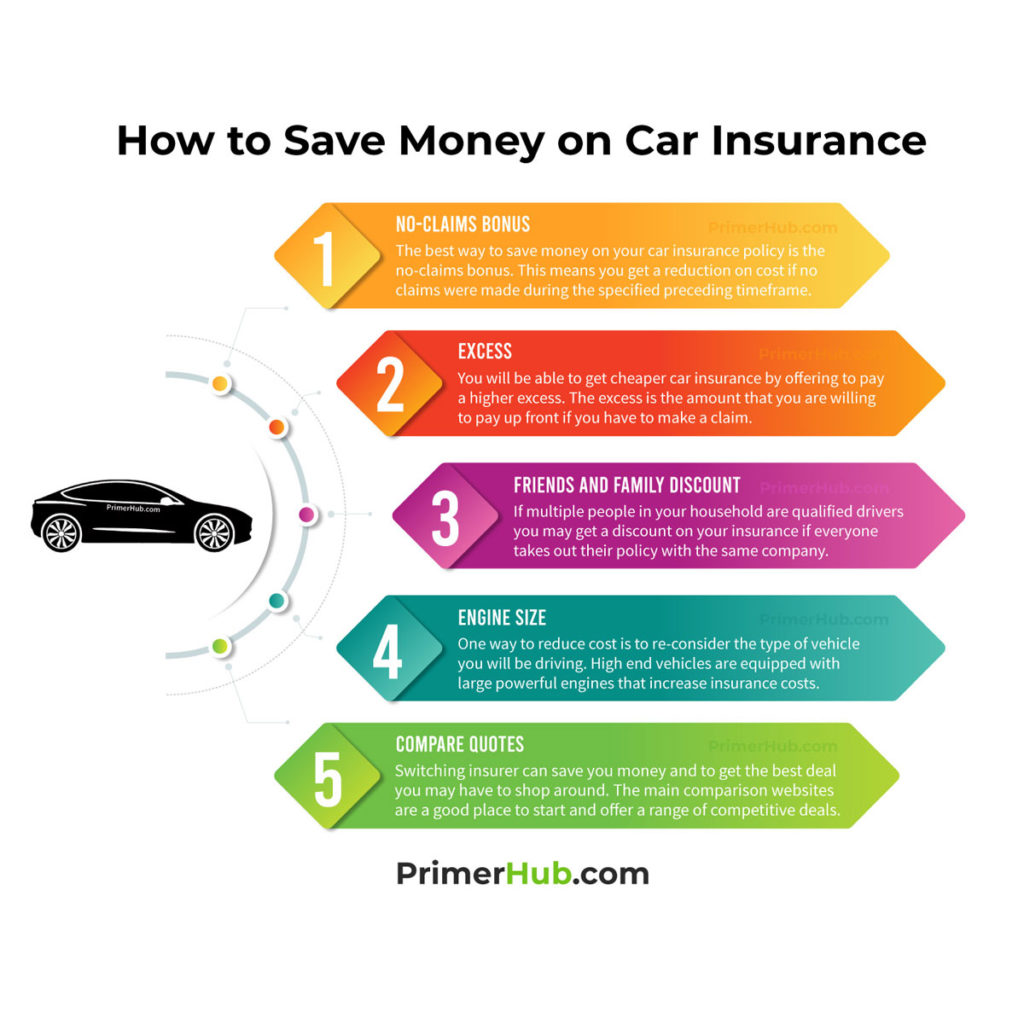

1. Go for Best Conditioned Car

A tip to our readers before doing any insurance shopping make sure to know which type of car you have.

This matters a lot as it will determine your next monthly insurance premium. If you purchased a car which is brand new and have advance specs and technology, then be ready for a higher premium because of the comprehensive plan for your brand-new car maintenance and its security coverage

It doesn’t mean that you get yourself a cheaper car that is well used and have some malfunctioning issue in that case too your premium would be high as you will become a high-risk driver for the insurance provider and they will charge you more.

Therefore, for cheaper car insurance be smart and get yourself a best suited is that it is roadworthy to drive and have minimum mileage and speed rating.

2. Get a Comparison Car Insurance

In order to avail Cheaper car insurance, you need to understand the concept behind car quotes comparison.

Car quotes play a very important role in determining your premium. It presents a comparison rating list.

You can easily analyze which car got a suitable insurance rate.

Hence, to know about your premium visit our site and in three simple steps, you can get car quotes comparison.

3. Safeguard Your Car and Get Cheaper Car Insurance

Be a responsible car owner and protect your car not only form theft or by installing a lock system but also driving safely.

If your car got stolen within the first 6 months then this will automatically enhance your insurance cost. As for the provider, you become a short-term policyholder and in time of renewal, they will charge you a little high.

The same is the case when you are involved in an unforeseen events like accidents then you become a high-risk driver.

Therefore, you can make a decision of not letting insurance providers to cover you in those times fully but only you are sure and confident in your car safely and of curse on your driving skills.

4. No- Claim Discounts

No Claims Discount is a certificate that a policyholder receives if they have not made a claim in the recent past. Based on this certificate, the policyholder could get a discount on the renewal of their motor insurance policy.

According to the UAE auto insurance regulation policyholders who make zero claims get rewarded. Zero claims mean that the policyholder has been an exemplary driver, and their reward is a discount on their premium.

Therefore, for cheaper car Insurance, no-claim discount is a unique and effective way to secure better deals in the insurance market.

5. Mileage Matters A lot:

The insurance provider checks your car mileage and how much kilometer it runs to determine your premium.

The reason behind this is to know how responsible a driver you are.

For affordable auto insurance, all you have to do is control your speed limit and try carpooling or taking a taxi to save mileage in time of getting new insurance policies.

Hence, the idea is to make your car a less-risk vehicle in front of the provider.

5. Car Rental

Many people who are expats/visitors or preferred to get a rented car for long drives in order to give a rest to their owned vehicles and avoid the expense of wear and tear their car can bear on long trips.

Therefore, save your money and get car rental insurance in your package.

Conclusion

Cheaper car insurance doesn’t mean to comprise your coverage it means how you save your money and get suitable coverage that you really need.

These tips and tricks are strongly linked with each other in order to lower your premium.

Thus think of the box and save more.